Tucker Financial Weekly Market Review: July 15, 2022

Weekly Market Report: July 15, 2022

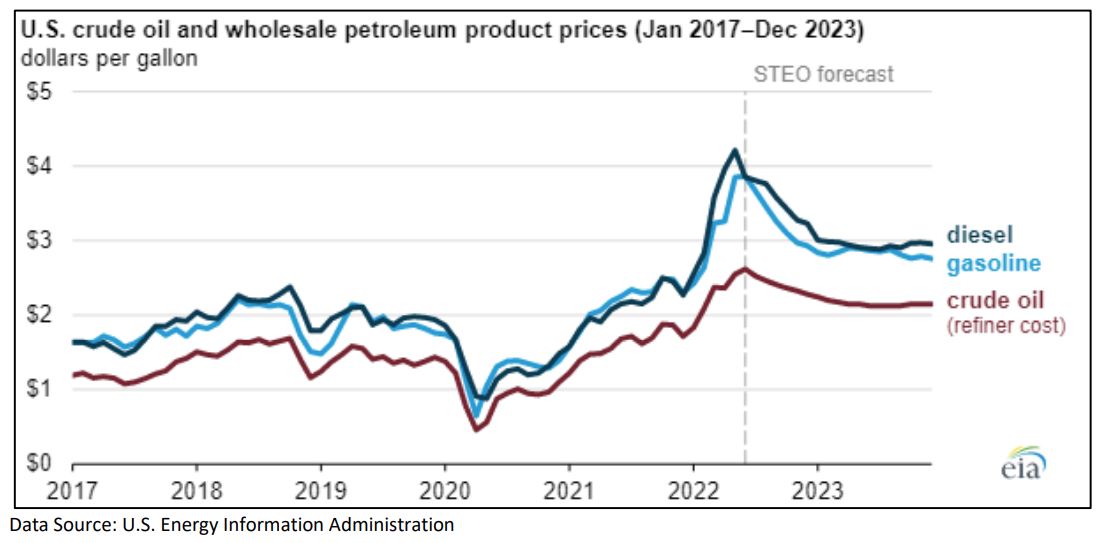

Last week brought us another up and down week with the official start of second quarter earnings and several highly anticipated economic reports as the key focus points. By the end of the week, we saw most global equity markets close down with U.S. (-1%), developed international (-1.5%), and emerging international (-3.6%). Inflation and growth concerns weighed heavily on risk appetite which translated to a strengthening USD, a rally in longer dated U.S. Treasuries, and a selloff in shorter dated U.S. Treasuries. Commodity markets were down again, losing 5.6% on the week, as oil closed back below $100bbl, gasoline prices fell but natural gas surged 16% to over $7.

Market Anecdotes

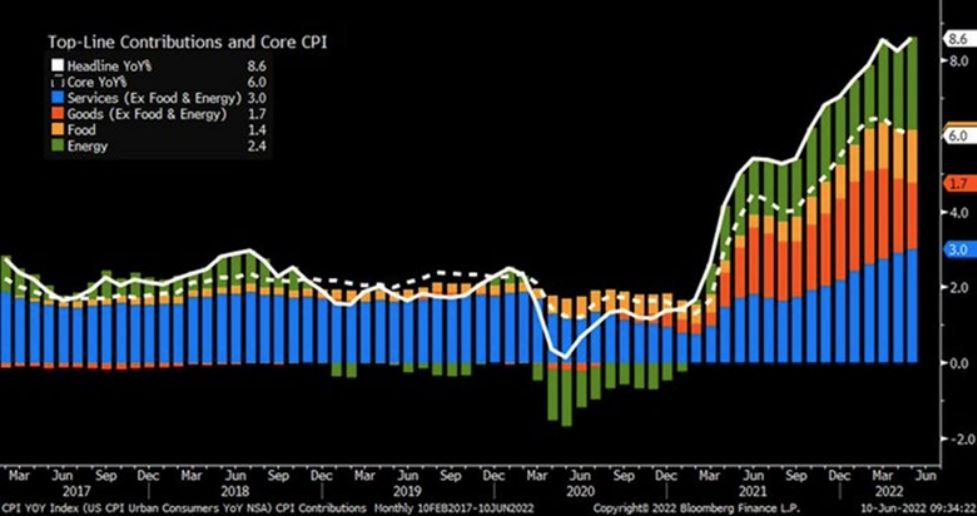

n eye watering July CPI report pushed market expectations for FOMC interest rate hike in July to 100bps immediately which slipped to 31% by week’s end. There was nowhere to hide across the subcomponents with gas, shelter, and food the driving forces.

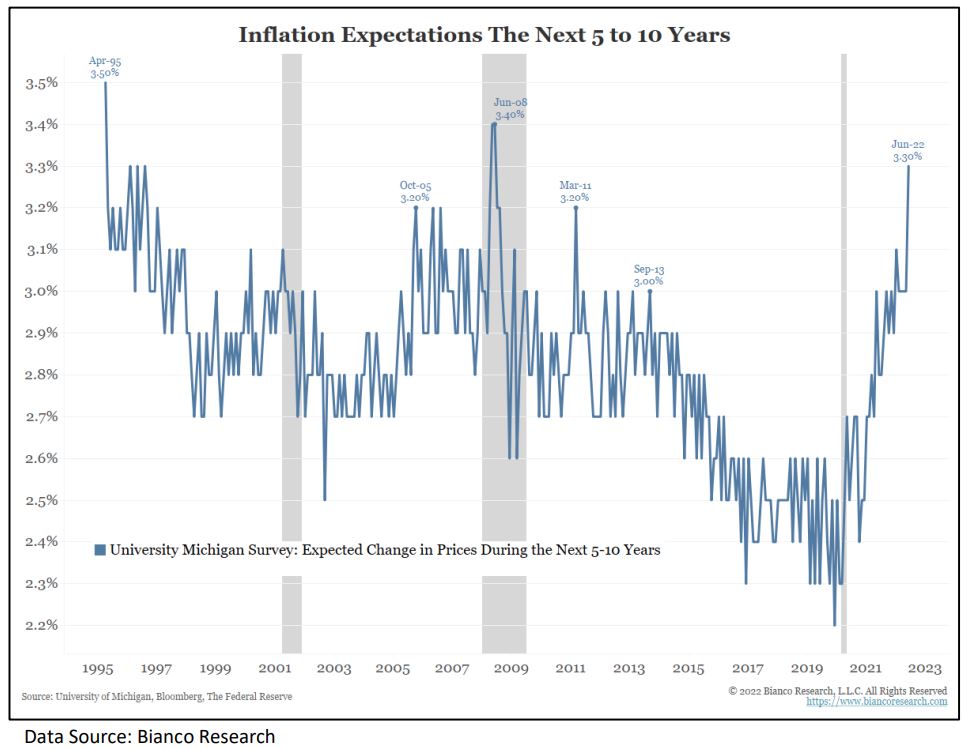

• According to the New York Fed’s Survey of Consumer Expectations, the median 1 yr fwd inflation expectation surged to 6.78% while the median 3yr fwd fell to 3.62%.

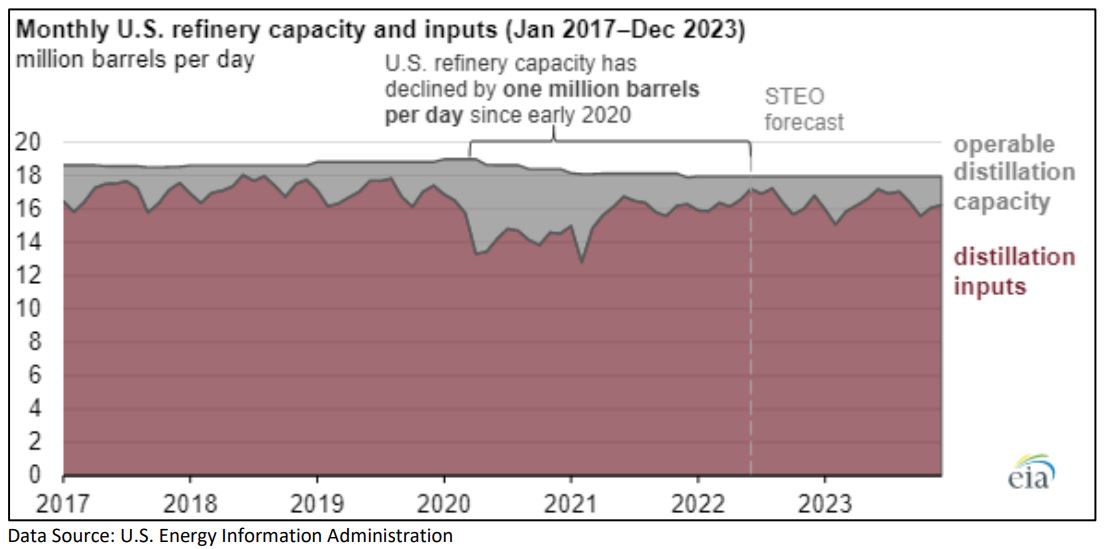

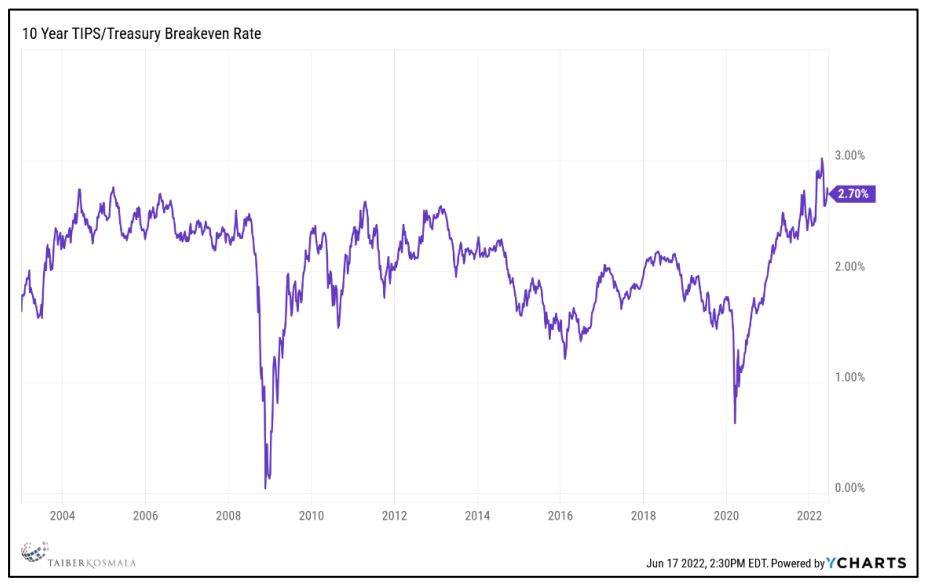

• The strong USD should cut into inflation and GDP growth on a lagged basis, something the Fed is considering with respect to monetary policy. Softening commodity prices should also factor into near term inflation trajectory.

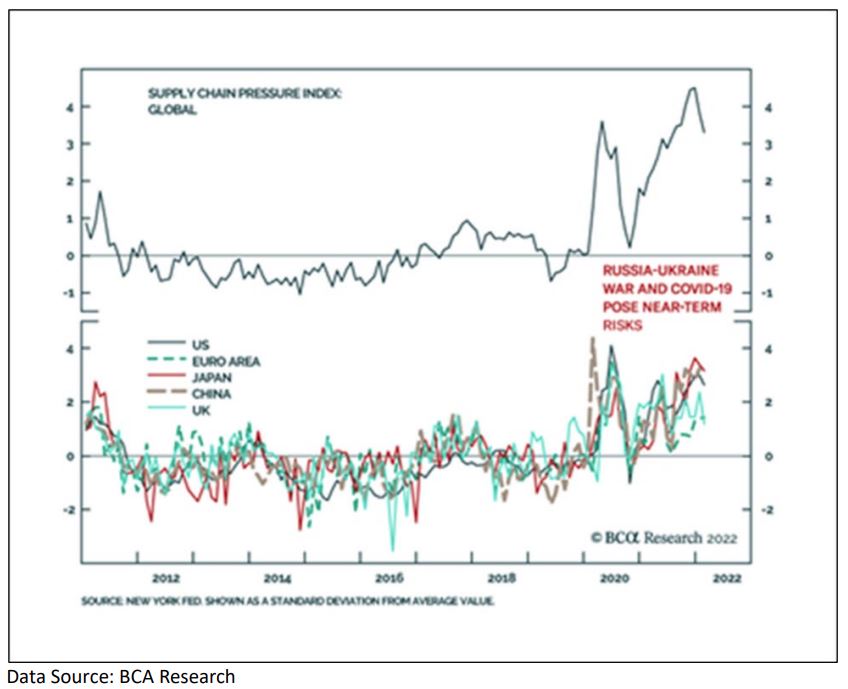

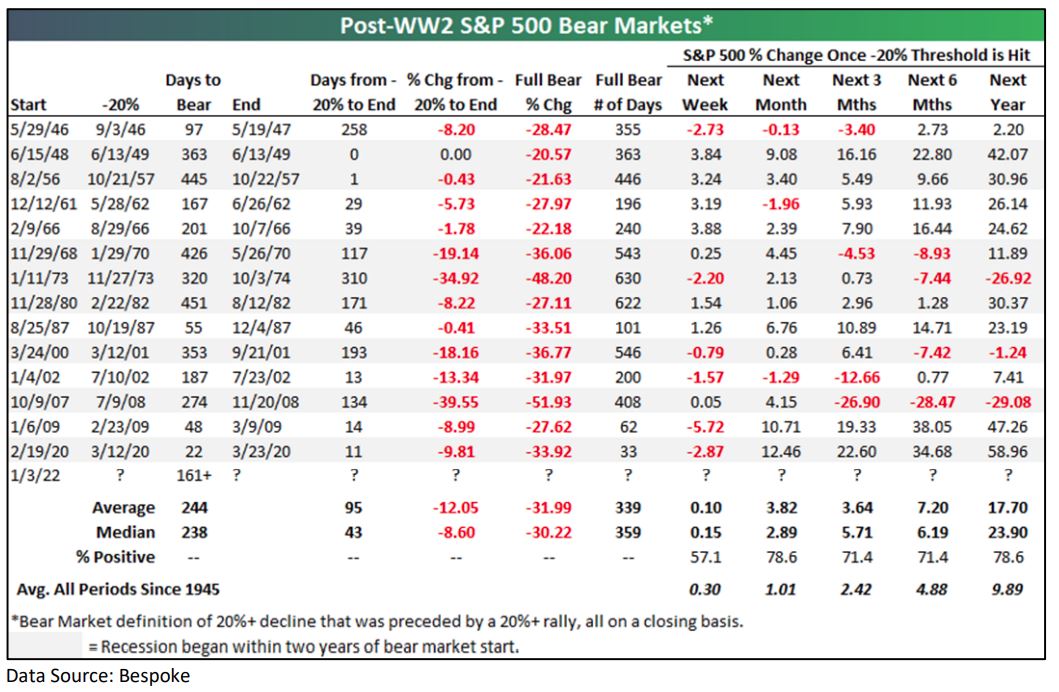

• Bespoke referenced a ‘bull whip effect’ as an interesting analogy to the aggregate demand and supply chain issues plaguing the economy since March 2020 in the form of an unprecedented pandemic demand shock and a series of overcompensations and over corrections by consumers, inventory intermediaries, logistics suppliers, producers, policy makers, and governments.

• The U.S. 2yr/10yr yield curve has fallen into its deepest inversion (-0.227%) since 2001 but the 3m/10yr (0.78%) remains slightly positive, at least until the FOMC hike later this month.

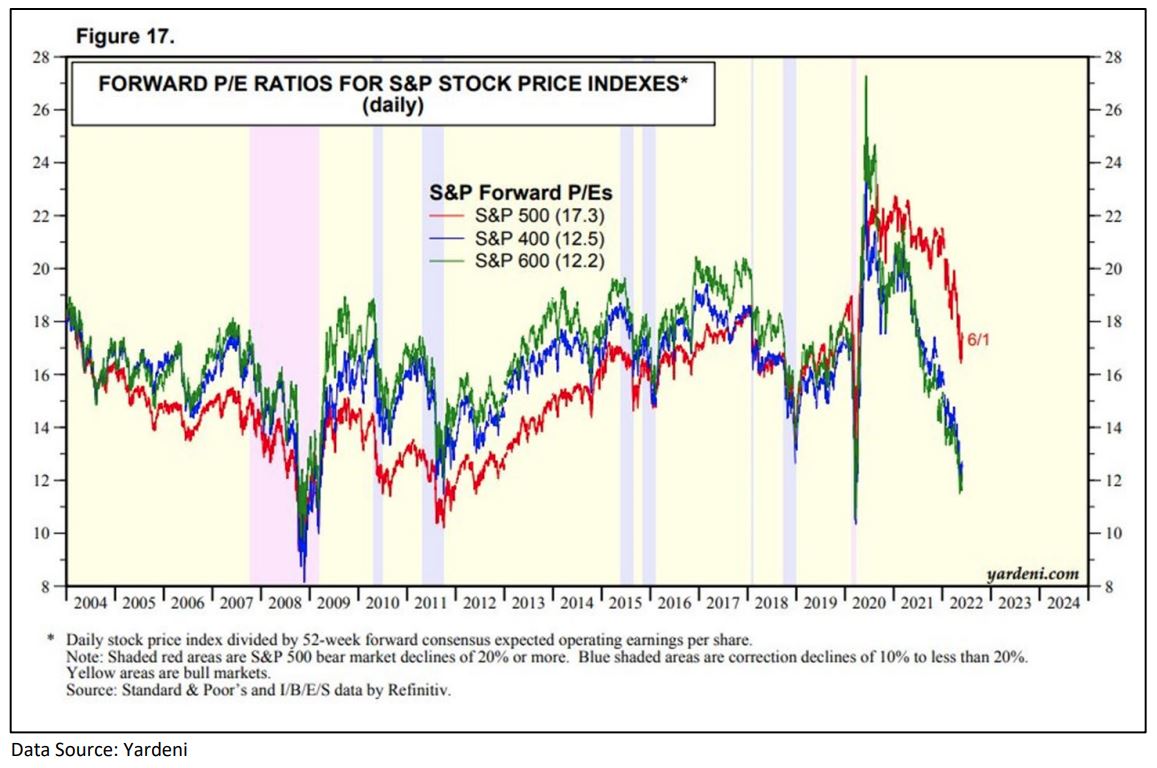

• Second quarter earnings started last week with reports from the banks. With 7% of the S&P 500 reported, we have a beat rate of 60% and a beat margin of 2%, taking blended earnings down to 4.2%. Revenue beats of 60% and beat margins of 0.8% are also coming in below average.

• The Bank of Canada hiked rates by 100bps and the RBNZ by 50bps to take both reference rates to 2.5%. The ECB meets this week and the FOMC on the 27th with markets pricing in rate hikes from both central banks as well.

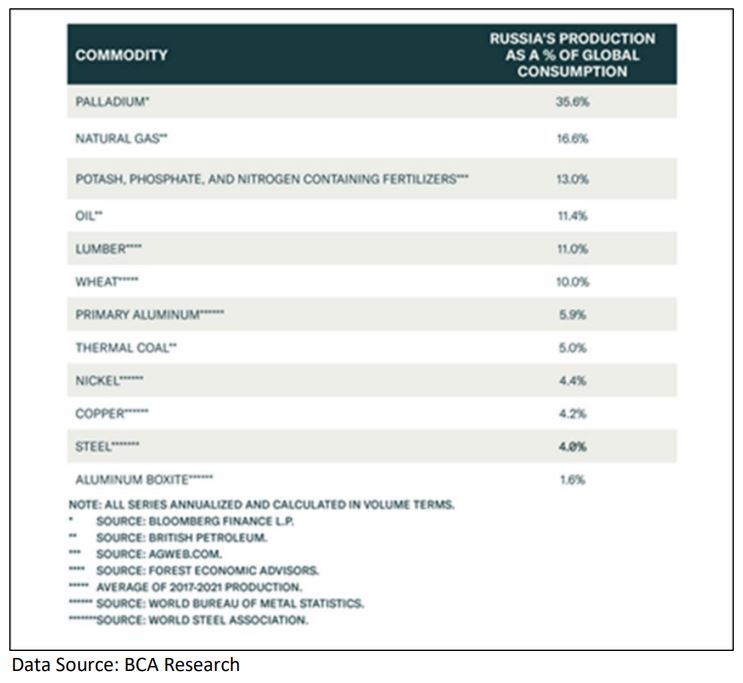

• ZEW Survey of German investor sentiment fell to its lowest level since 2011 as inflation concerns abound. Natural gas concerns continue to rattle Europe with efforts to reduce reliance on Russian gas leading to increased likelihood that Russia will use the leverage while it still has it.

• Fresh political turmoil in Italy contributed to a rough week for European equities (-4.2%) with Mario Draghi tendering his resignation which was promptly refused by the head of state.

• A JPMorgan Chase report related the significant increase in interest rate (bond market) volatility to less market liquidity under the vastly expanded size and scope of the U.S. Treasury market noting BrokerTec data indicating only 25% of market depth relative to the past decade.

• Our strategists are discounting China’s record trade surplus posted in June as well as the 2.6t RMB infrastructure package recently announced.

Economic Release Highlights

• Retail Sales for June bounced back from May’s disappointing result with headline (1%a vs 0.9%e), ex-vehicles (1%a vs 0.6%e), and ex vehicles & gas (0.7%a vs -0.2%e).

• June CPI rose more than expected on the back of May’s upside surprise. Headline CPI jumped from 8.6% to 9.1% YoY and from 1.0% to 1.3% MoM. Core CPI moved from 6% to 5.9% YoY and 0.6% to 0.7% MoM.

• UofM Consumer Sentiment for July of 51.1 came in slightly higher than the forecast of 50.0 but was generally within consensus range of 48.4-53.0.

• NFIB Small Business Optimism Index tumbled to 89.5 in June, falling short of the 92.9 consensus estimate.

• June Industrial Production came in short of consensus (-0.2%a vs 0.1%e) with manufacturing output of -0.5% also missing consensus call for 0.2% growth.